Balances grow, but so do share stocks – Retirement Research Center

Do participants understand their risks?

It's always fun to see Vanguard's recent version of How to Save, which sums up the activities of 401(k) customers the previous year. Of course, no company's activities provide a complete picture of retirement preparation. An individual may have more than one 401(k) account, with accounts of more than one company often being cashed into an IRA that financial services companies cannot track. Furthermore, it must be necessary to provide a balance rather than a family basis.

While full images are only available in family surveys, Pioneer Reports always provide food for the mind. This year, what shocked me is the percentage of 401(k) assets in stocks – about 80% of people under 65 years old. I'm not paying attention to equity holdings, and this number makes me very high. However, before looking at the equity issue, let me provide an update on the 401(k) balance.

It is the second consecutive year for the economy and stock markets since 2024, and it is no surprise that participation rates, contribution rates, medians and average balances are all close to historical climaxes. The average balance in 2024 rose from $134,100 in 2023, and the median balance rose from $35,300 in 2023 to $38,200 (see Figure 1). The mean balance is more typical, long-standing wealthy participants, while the median represents the typical participants.

As mentioned above, the percentage of these balances invested in stocks seems to be high. For those with working age, the percentage of people under 45 years of age is over 85%, down to 64% before retirement (see Figure 2).

In fact, equity holdings are currently the highest since 2000, just before the outbreak of the Dotcom Bubble, at a low of 61% in 2008 during the financial crisis (see Figure 3). Due to the introduction of target date funds, most of the growth is purposeful, which increases age-appropriate equity allocations and reduces extreme allocations. Furthermore, if one person looks at all investable assets, many households may be more diverse than just 401(k) holdings. That is, those with lower household incomes are unlikely to own any other financial investment.

Although the target date fund has intellectual cases, it is hard not to worry at the moment. Stock risk. Yes, they are the most profitable publicly traded assets, but volatility in returns measured by standard deviation is also important (see Table 1).

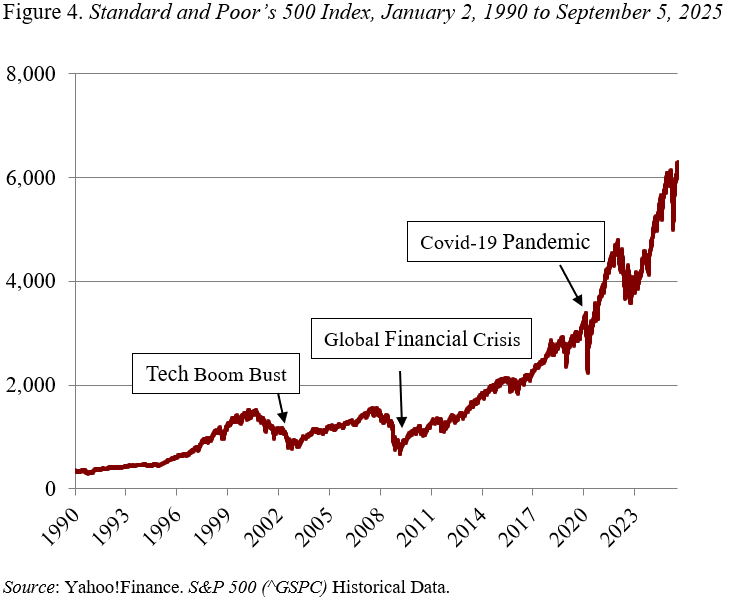

As time goes by, the risk decreases is not the case. Even if the short-term return merges to expected values over time, volatility expands the range of possible wealth outcomes. Additionally, retired participants are at risk of retirement sequence when they begin withdrawing assets. That is, early gains in the early stages of retirement (continuous withdrawal rate) will lead to lower lifetime income. Finally, look at where the standard and poor 500 index is (see Figure 4).

Stocks have obviously been a good investment over the past three decades, with target date funds improving the way they invest. However, this takes a lot of work to make people feel comfortable saving for their retirement. Do they know how they are exposed to the stock market? Would they be happy if they knew?