Do we really want Rose’s retirement plan to be more generous than traditional plans? – Retirement Research Center

Eliminating the required minimum distribution makes the Ross 401(k)S more valuable.

I'm sneaking stuff. The Security 2.0 Act eliminates the required minimum distribution (RMD) of Ross 401(k)s. At first glance, this change seems relatively harmless. After all, account holders pay taxes upfront, so why force them to withdraw their money. This reason ignores that even after the account holder reaches 73 years of age, the assets in Ross continue to generate tax-free benefits, i.e. the age at which RMD initiates traditional programs. The ability to continue saving tax exemptions makes Ross more valuable.

A quick review of what is called equivalence between traditional plans and Ross plans might be a great way to clarify what is going on. Under the traditional 401(k) plan, the government does not tax the original donations, nor does it tax the returns of those donations until funds are withdrawn from the plan. In contrast, initial donations to Ross are not deductible, but when withdrawing the money, interest income is tax-free and tax-free.

While traditional and Rose’s plans may sound very different, the traditional argument is that they offer nearly the same tax benefits. Unfortunately, the easiest way to prove this is with equations. Assumptions t is the individual's marginal tax rate and r is the annual return on planned assets. If individuals contribute $1,000 to traditional programs, n Year, the balance will increase to $1,000 (1+r)n. When an individual withdraws accumulated funds, both the original donation and the accumulated income are taxable. Therefore, after retirement, the after-tax value is (1-t)$1,000 (1+r)n.

Now consider a Rose. Individuals pay tax on original donations, so he says (1-t) $1000 to enter the account. After n years, these after-tax gains will grow to (1+r)n (1-t) $1,000. Since the proceeds are not subject to any further tax, the after-tax amount under Ross is the same as the traditional plan:

Note that a key assumption in this exercise is that in both cases n (the number of years accumulated) is the same. That used to be true. In both cases, RMD has limited tax-free accruals. Now, for traditional and Ross 401(k)s, “n” is no longer the same. The owners of traditional plans must take their money from the age of 73; the owners of Ross do not have to take their money. (The minimum allocation rule after death still applies.)

One argument for changing the RMD rules seems to be to make the Roth 401(k) handle consistent with the Roth Iras, which is never bound by RMD. Consistency is a good goal. Congress just flipped in the wrong way.

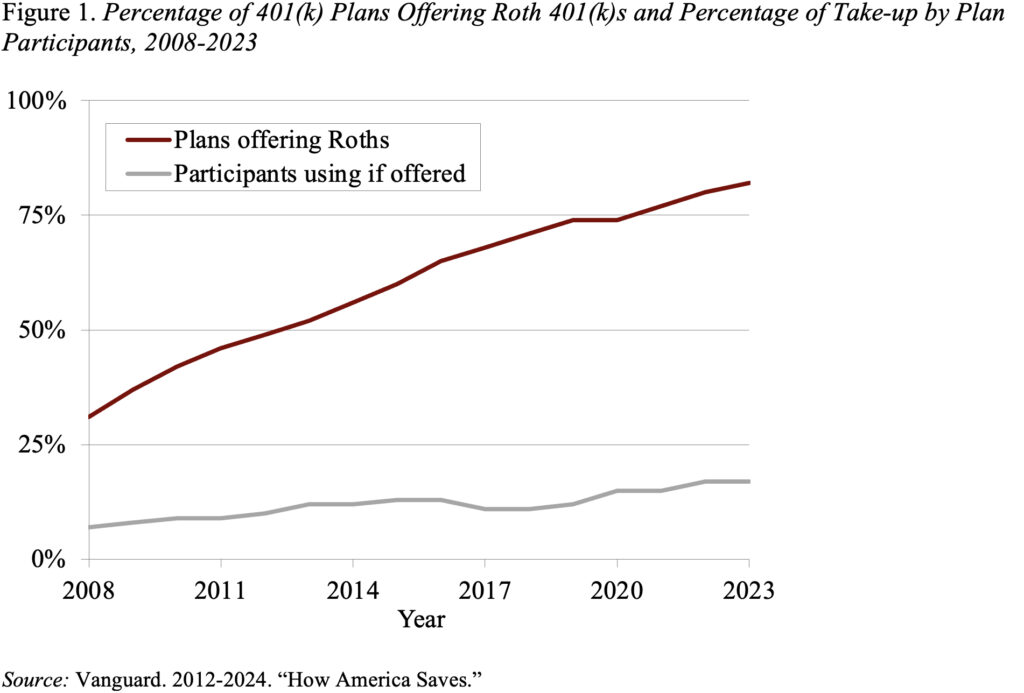

Flip the wrong way to make the government make money. Currently, even though 82% of employers offer the Rose 401(k) option, only 17% of participants accepted the offer (see Figure 1). This percentage will increase as more workers realize that there is no advantage of RMD. As a result, tax expenditures for retirement plans – wasteful expenditures under any regime – will increase. If Congress is looking for money, introducing RMD for Roth IRAS and restoring RMD for Roth 401(k)S will not only make tax benefits fairer, but will also increase revenue. That must be a good thing!