Increased immigration can improve the financial situation of social security – Retirement Research Center

Are the Social Security Trustees too optimistic?

this 2025 Social Security Trustee Report It confirms what has been obvious in nearly three decades – that is, the 75-year financing gap faced by social security is currently equal to 1.3% of GDP. And if nothing is taken before 2033, depletion of reserves in retirement trust funds will result in an automatic cut of benefits by 23%. And, as widely noted, the indicators are a little worse than last year’s report. The estimated 75-year deficit rose to 3.82% of taxable wages, compared with 3.50% in 2024.

As always, the focus of the trustee report and subsequent discussions in the press are based on intermediate assumptions. What will happen to the cost of the plan if the basic assumption is too optimistic? one Earlier blog It is believed that our fertility rate (currently 1.63 children) will likely remain low and result in a 75-year deficit of 4.49, rather than 3.82% of taxable wages (see Table 1).

The important thing to remember is that having your own baby is not the only option. Increasing immigration is a direct way to increase the worker-to-retirement ratio and improve the financial status of social security. The problem is that we seem to be moving in the wrong direction.

As we all know, future immigration patterns are difficult to predict; traffic depends on the economic and political conditions of the immigrant country and the United States. However, the task here is much simpler – assessing how the expected model is affected by current and future administration attitudes toward immigration and immigration.

The social security immigration forecast involves estimating the net flow of two types of immigrants – legal permanent residents and temporary or illegal residents. Temporary/illegal immigration includes those who enter legally but only receive temporary authorizations (such as students and foreign workers with visas), as well as those who over-the-top visas and those who enter illegally.

In the 2025 report, the total number of annual immigration (under the intermediate assumption) of the two groups averaged an average of 1,253,000 between 2035 and 2099. In total, 788,000 are legal permanent residents and 465,000 are temporary/illegal immigrants. The final level of immigration assumption remains the same as last year's report. Social Security Forecasts Are Fair Continuous With people from other federal agencies.

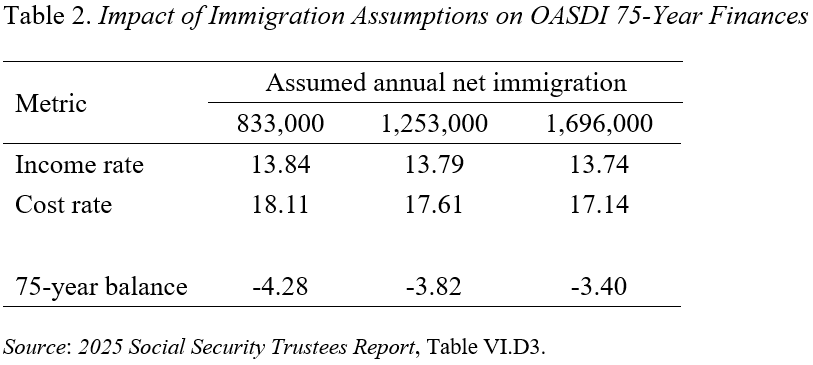

Like other assumptions, the trustees both present a more optimistic (low cost) and pessimistic (higher cost) projection for immigration (see Table 2). Additional immigration helps social security finance in a variety of ways. First, the cost rate drops because immigration occurs at a relatively young age, and therefore at least in the short term – lowering the retirees to workers ratio. Second, temporary/illegal immigration often contributes to social security, but – without changing its status – temporary immigrants are often not eligible for benefits, while illegal immigrants have never been. Third, immigrants tend to have more babies than native-born Americans, which increases family fertility and further improves the prospects.

The government’s policy is to eliminate all illegal immigrants, whose actions (e.g., unless foreign students) may lead to less legal immigration. If future immigration flows end up being closer to pessimistic assumptions, the actuarial deficit in 75 years would be close to 4.28% of taxable wages, rather than 3.82%.

In addition to reducing future immigration flows, President Trump Election Currently, 150,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000,000, From Pew Research Center and Other scholars The number of immigrants here illegally placed at nearly 11 million. However, if such an effort is successful, it will increase the number of beneficiaries per worker. Higher cost rates will further increase the 75-year deficit, while the immediacy of the impact will accelerate the depletion of trust funds by about a year.

In short, at this point, policy makers seem uninterested in using immigration to offset low fertility rates in the United States. Indeed, if we follow the current path, the decline in immigration alone will make the 75-year deficit of Social Security higher.