Is the assumption of the Social Security Trustee too optimistic? – Retirement Research Center

What happens if fertility remains low?

this 2025 Social Security Trustee Report It is the standard fare. It confirms what has been obvious for nearly three decades – that is, the 75-year financing gap faced by Social Security is currently equal to 1.3% of GDP. And if nothing is taken before 2033, depletion of reserves in retirement trust funds will result in an automatic cut of benefits by 23%.

The indicators are worse than last year's report. The estimated 75-year deficit rose to 3.82% of taxable wages, compared with 3.50% in 2024. The estimated exhaustion date for Old Time and Survivor Insurance (OASI) Trust Fund assets has not changed; it remains in 2033. Yes, the Disability Insurance (DI) Trust Fund has enough fees to pay benefits throughout the 75-year period, so the combined OASDI Trust Fund is depleted in 2034, a year earlier than last year’s report. But combining the two systems will require a change of the law; therefore, under the current law, the action date is 2033 to eight years.

However, all of these figures are based on the intermediate assumptions of the trustee. Will the cost of the program remain low, will policy makers deport millions of immigrants and lower future immigration levels, and will people live longer than expected? This blog focuses on fertility assumptions.

Fertility rates in the United States have generally been declining since the infant boom in the mid-1960s and have accelerated after the Great Depression. Many observers believe that once the economy recovers, fertility rates will rebound. It does not (see Figure 1). Today, a woman's hypothetical number of lives in a childbirth year is 1.63.

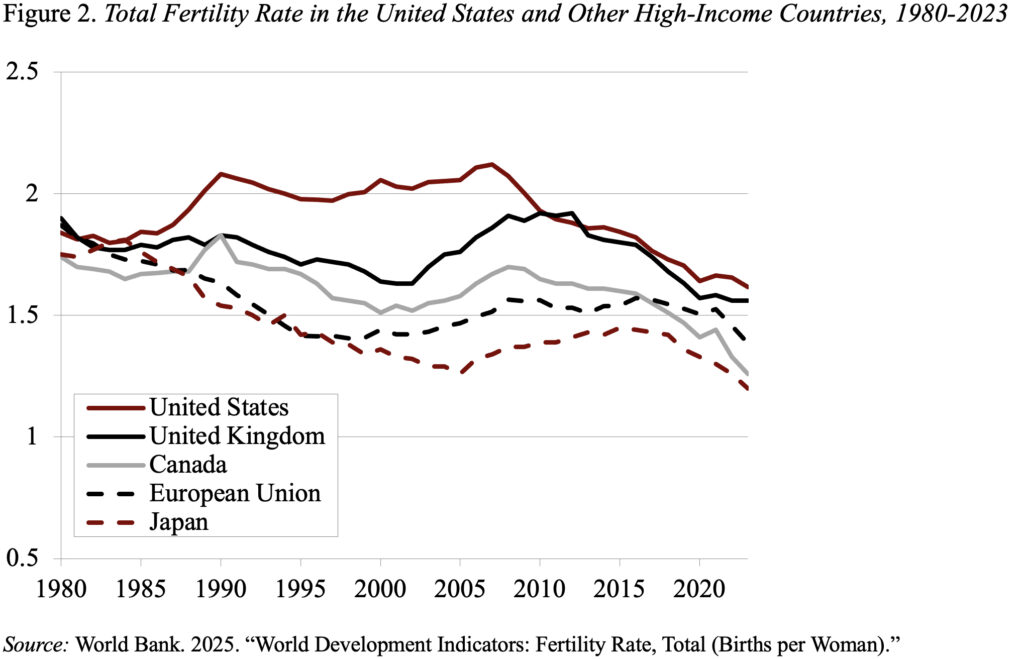

The current fertility rate in the United States is not abnormal. Now, it roughly matches the prices in other high-income countries (see Figure 2).

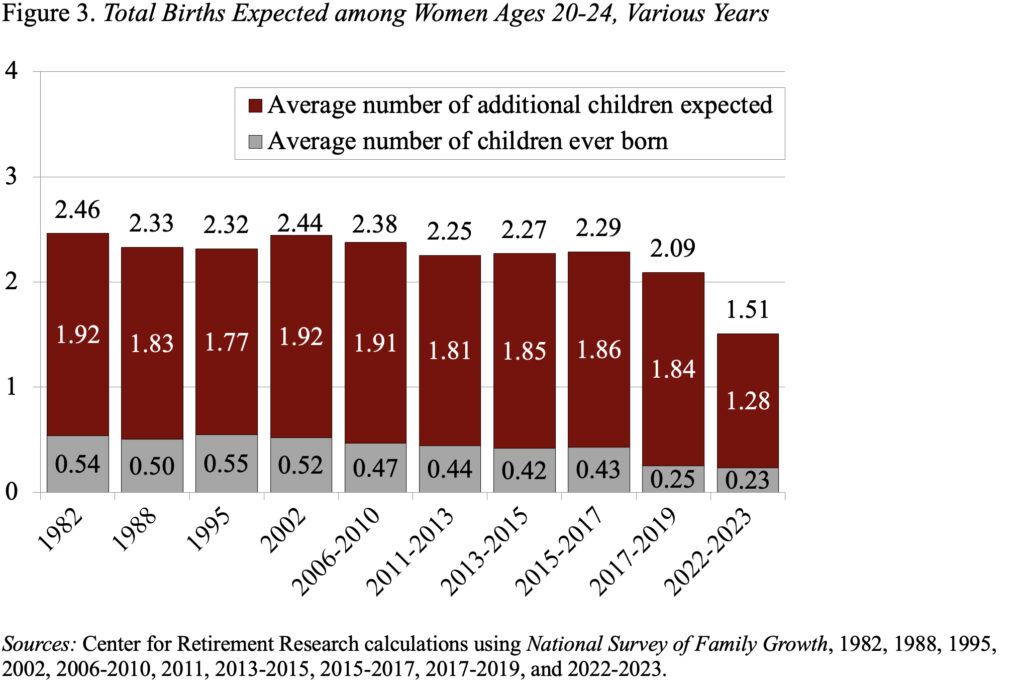

Social Security Trustees are well aware of these numbers but predict the ultimate fertility of 1.9 children. The trustee is based on two factors. First, repeated surveys of women of childbearing age showed birth expectations above 2.0, suggesting that the current low levels will not be permanent. Second, they argue that women’s fertility increases in their 30s support the notion that women are just raising children.

However, the trustee's projected fertility rate is significantly higher than the Congressional Budget Office, which has a final fertility rate of 1.60, and by 2035, the Census Bureau will continue to decline to 1.60 in 2050 and 1.60 in 2100.

Additionally, the latest expectation data (released after the trustees set the assumptions for this year's report) suggests that women under the age of 35 expect less than 2.0 children. In fact, today's 20-24-year-old young people only want to have 1.5 children (see Figure 3).

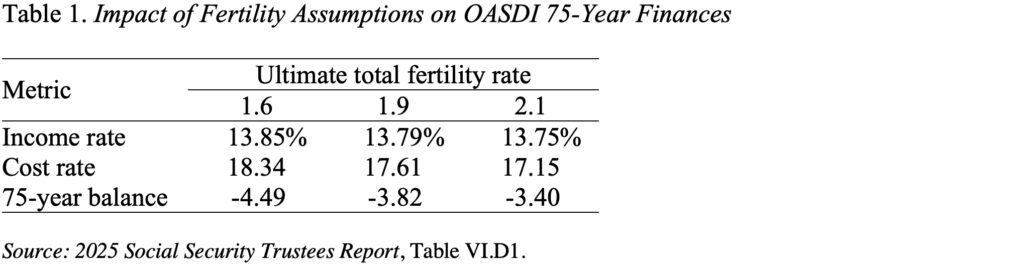

According to the trustee's sensitivity analysis, the final fertility rate of 1.6 instead of 1.9 will increase the 75-year deficit from 3.82 to 4.49% of taxable wages (see Table 1).

Can the closest policy increase fertility? The challenge is that over the past 30 years, many countries have developed pro-family policies – based on child welfare, providing newborn allowances or providing child tax credits. this evidence It shows that these efforts are not working. Sweden is a great example because even soup to soup fertility is 1.45, which is much lower than the US rate.

If the continued fertility is low, the trustee will eventually have to reduce its assumptions. Lower assumed fertility could generate a 75-year deficit in the range of 4% to 4.5%. But even if the deficit is expected to be higher, leverage can be used in terms of income and interests to restore the balance of social security. Congress just needs to take action.