Lowering the salary of federal jobs is bad for workers – bad for the United States – Retirement Research Center

Looking ahead, governments will have to pay more (not less) to be competitive.

The recommended income proposal originally included in Trump’s “a large bill” would increase federal employees’ contribution to their identified welfare plans. If federal employees are paid more than private sector workers and contribute less, it may be a good idea to increase their contribution rate.

| Specific proposal: The federal government sponsors retirement benefits through the Federal Employee Retirement System (FERS), which is jointly funded by employees and their institutions. Employee contributions are considered federal revenue. Participants employed before 2013 now contribute 0.8% of their salaries, 3.1% of those employed in 2013, and 4.4% of those employed in 2014 or later. Under the proposal, all employees will contribute 4.4%. During the 2025-34 period, the increase in contribution rate will be phased out and generate approximately $35 billion in revenue. (Note: The proposal was canceled before the bill was passed by the House, but it is likely to reappear in the Senate version or in the future.) |

Total compensation includes cash wages and accompanying benefits, mainly health insurance and employer contributions to retirement plans. According to the Congressional Budget Office, federal employees always pay less than private sector workers for employees with college degrees or higher (see Figure 1). However, for federal workers, the benefits are more generous, which completely compensates for the low wages of those with bachelor’s degrees, but federal workers with higher degrees are still insufficient. By contrast, at lower levels of education, federal workers earn more than private sector income.

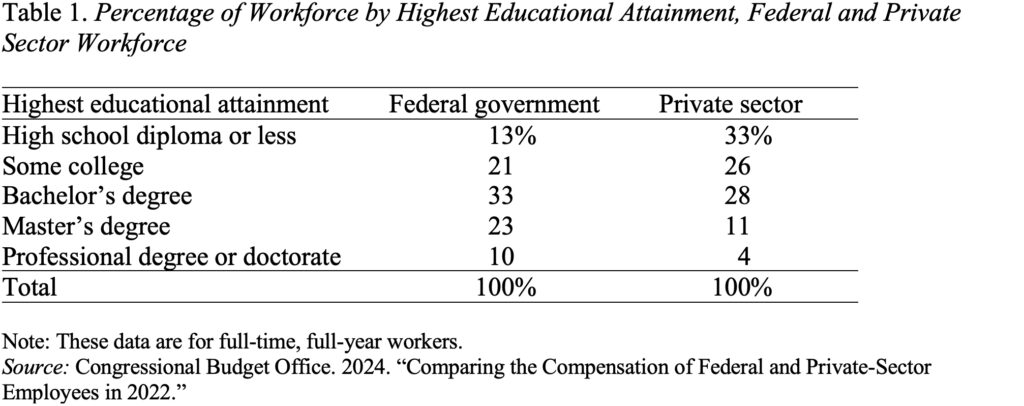

To understand the weights of various comparisons, it is important to know how many workers belong to various educational reservoirs in the federal and private sectors. As shown in Table 1, two-thirds of federal workers have a bachelor’s degree or higher, compared with 43% of private sector workers. That is, most federal workers are paid less than those in the private sector.

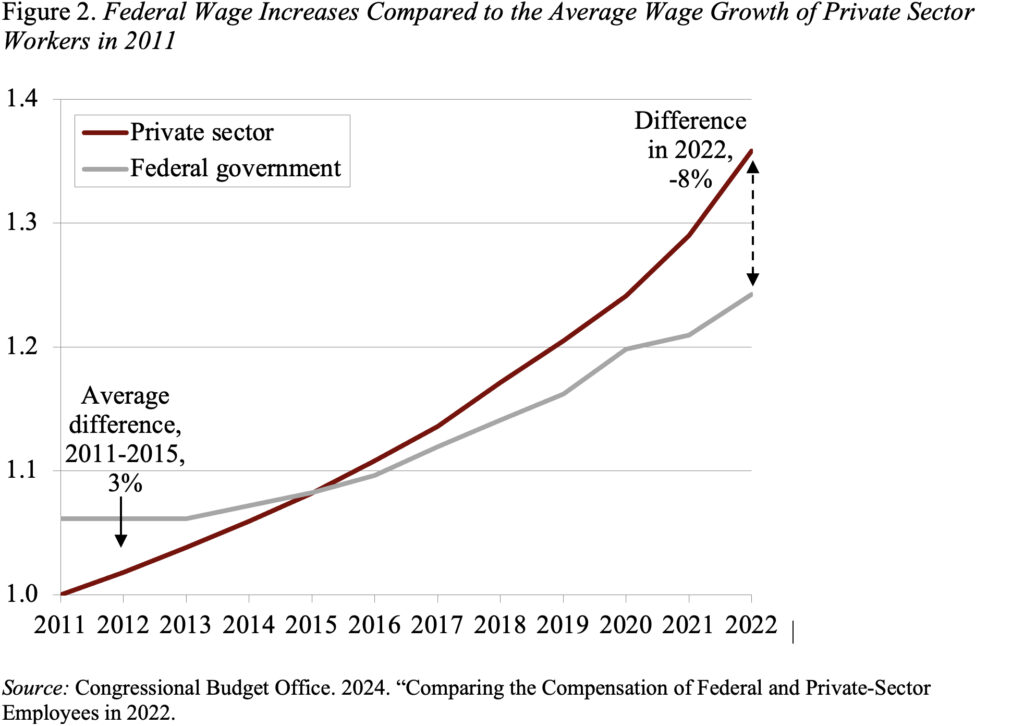

Furthermore, the relative position of federal workers has been deteriorating over time. In 2015-2015-CBO's last compared year with 2022, the excess pay for less educated federal workers and the underpaid pay for the most educated federal workers increased. The relative decline in federal compensation reflects a smaller cross-salary increase (see Figure 2), which also reduces the increase in pension costs and other benefits closely related to wages.

You might ask, why are well-educated people willing to work less in government? CBO provides several reasons – the most prominent is work safety. “Workers value employment security, and federal employment provides more than many jobs in the private sector.” Well, thanks Doge, this is no longer true. As a result, to remain competitive, the federal government will have to provide substantial compensation for more educated workers.

Most importantly, any advice to reduce full compensation for federal employees is moving in the wrong direction.