People should know about various personal finance blogs

Personal financial blogs mainly fall into three main categories. First, there is the “Get Out of Debt” blog. Secondly, there is a personal financial blog that “just graduated from college”. Third, there is a personal financial blog with “career track”. Of course, there are more categories like retirement blogs or i-won-the-lottery blogs, but that's the biggest.

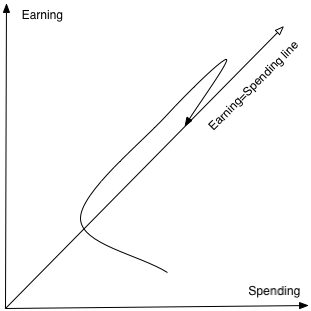

Below is a diagram describing this triad.

X-axis displays expenditure. The Y-axis shows revenue. The diagonal line shows where income equals expenditure. Those in debt spend more than they earn, so they are below the diagonal. “Graduates” (young people) have lower incomes, but hopes are also low. At that moment of life, there is a tendency toward income due to the relatively low income. The main group is what I lacked better words called Career Track Blog. Spending here is 15% lower. As income and expenditure gradually grew higher, this track lasted for 30-40 years due to the continued profits of retaining retirement plans. Since a specific blog shows a snapshot of a person's financial time, drawing all bloggers at once The typical financial path one takes in our society. It looks like this. If any amateur astronomer read this article, think of similarities with the typical evolution of stars on Herzpreen Roselto. No, there is no hidden cosmic meaning here

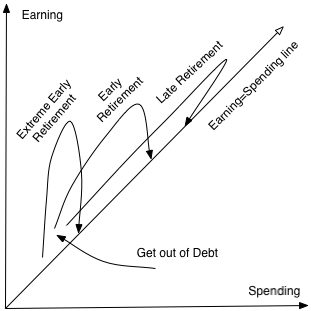

One person in this graph can start with the debt or expenditure = income line. They remain constant as income gradually increases to 15%. As income continues to rise, expenditures have been adjusted accordingly. After 30 or 40 years, the person retires with a moderate decline in spending (no buffet lunch, no commuting). This is what most people think about personal finance. Other paths may sound strange, or even impossible. There are other paths. Hope to put everything from perspective.  It can be seen that the typical path above is just one of several possible paths. The typical path corresponds to fulfilling student debts, then engaging in a career for 30-40 years, eventually paying off the debt and amassing a lot of money (ideally a $1-2 million retirement fund), then Retirement on high spending levels There is little attention to the spending of money. Can be achieved from early retirement with modest student debt, but save more money at 30-50% in 15-20 years You may retire early at the age of 40-50. This does require some budget control. This allows retirement between 30 and 40 years old. This requires a lot of money management and thrifty skills. Two conclusions drawn here are that by observing a large number of personal finance bloggers, you can understand how a person (a blog, to be precise) usually behaves throughout his life. Another person should also look at the “strange” blog to see other paths.

It can be seen that the typical path above is just one of several possible paths. The typical path corresponds to fulfilling student debts, then engaging in a career for 30-40 years, eventually paying off the debt and amassing a lot of money (ideally a $1-2 million retirement fund), then Retirement on high spending levels There is little attention to the spending of money. Can be achieved from early retirement with modest student debt, but save more money at 30-50% in 15-20 years You may retire early at the age of 40-50. This does require some budget control. This allows retirement between 30 and 40 years old. This requires a lot of money management and thrifty skills. Two conclusions drawn here are that by observing a large number of personal finance bloggers, you can understand how a person (a blog, to be precise) usually behaves throughout his life. Another person should also look at the “strange” blog to see other paths.

Copyright © 2007-2023 EarlyRetirementExtreme.com

This feed is for personal, non-commercial use only.

Using this feed on other websites violates copyright. If you see this notification anywhere in the news reader, you can get you to view the copyrighted infringing page. Some sites use random word substitution algorithms to confuse the origin. Find the original unrotten version of this post on EarlyRetirementExtreme.com. (Digital fingerprint: 47D7050E5790442C7FA8CAB55461E9CE)

Originally released 2008-02-28 07:18:59.