Social security is loved by people in the political field – Retirement Research Center

But they only want high earners to pay for the solution.

2025 is 90 due to all the Doge-driven turmoil in the Social Security AgencyTh The anniversary of the program. To celebrate, many organizations have published reports to assess the current status of the program and recommendations for reform. To catch up with my reading, I just finished “Social Security at 90,” a book released by the National Institute of Social Insurance (NASI) in January.

The report highlights the findings of the survey on about 2,000 respondents’ perceptions of social security and possible ways to eliminate the program’s 75-year deficit. When respondents were asked how important they think Social Security benefits are to their monthly income once retired, 65% to 90% answered “very important” or “somewhat important”. This pattern spans political affiliation (see Figure 1), age group, educational achievement and income levels.

The plan will go bankrupt in the early 2030s, and many young people think they may never get any Social Security benefits, so this broad support for the plan is encouraging. Neither is real. In the early 2030s, social security would not go bankrupt. Instead, trust fund reserves will run out of the gap between planned income and expenditure in the 2030s. However, payroll taxes that continue to join can cover about 80% of promised benefits. So even if nothing is done, people will continue to gain most of the benefits.

But no one wants to see the immediate cut of Social Security retirement benefits of 20% in full benefit. Therefore, most NASI reports focus on how respondents resolve this issue. Here, it is found not very satisfactory. Respondents will essentially raise more funds by eliminating the highest taxable income (making everyone’s entire income payroll tax and raising the payroll tax rate from 6.2% to 7.2% payroll tax.

While I think a modest increase in payroll tax rates should be part of any packaged closure Social Security 75-year shortage program, I really don't like the concept of removing the highest taxable income. My first problem is that it can disband any link between payroll taxes and benefits, which in the long run may undermine support for the program.

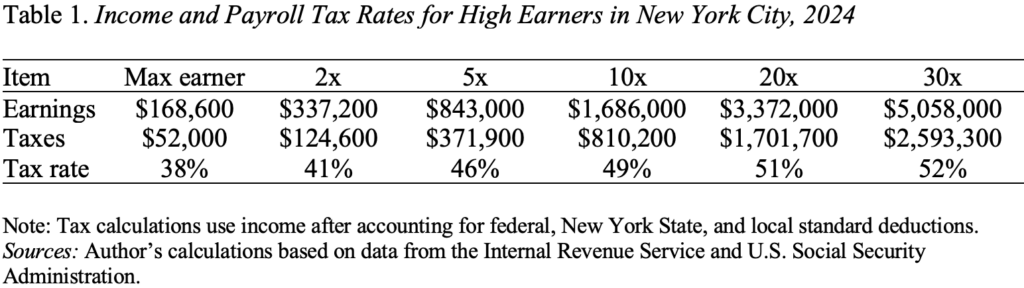

More broadly, I am concerned about further tax increases for those who earn all their income in the form of wages and wages. Indeed, quick calculations for people in New York City show that people who are truly high-income are in income (federal, state, and city) and payroll tax (Medicare tax should not be taxed plus singles income tax of over $200,000, and married couples with $250,000 income tax) (see Table 1). Efforts to increase tax revenue should be directed at investors who put a penny of stock in Roth IRA, those who enjoy the escalation of assets at the time of death, and private equity with interest rates of capital gains.

In short, surveys may help measure the public’s perception of the value of major programs like Social Security, but I don’t think they are particularly useful in designing reform proposals. In my case, I stick with Wendell Primus' cuts in benefits and tax increases.