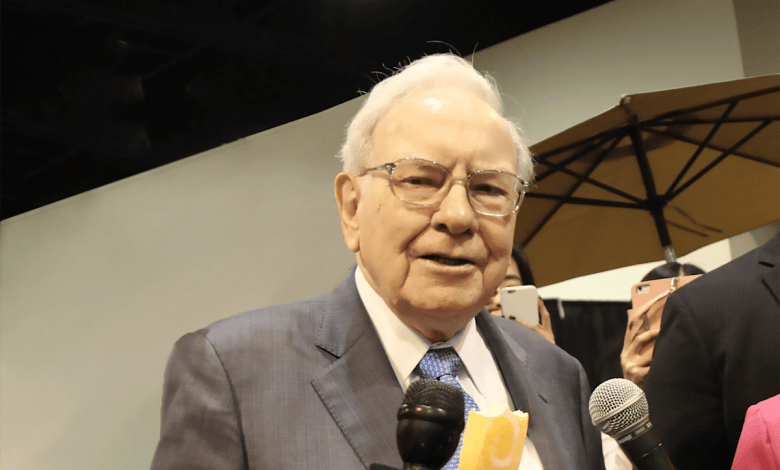

Warren Buffett said he wanted to buy this Pioneer ETF. It can turn $1,000 into $228,000 in 10 years.

-

Oracle in Omaha recommends that most investors put their money into low-cost funds tracking the performance of S&P 500.

-

A relatively small amount of capital invested per month may bring huge wealth in the long run.

-

The best investment strategy is a strategy that people can stick to in good times.

-

10 Better Stocks from Ours 10 ETFs ›

Warren Buffett just announced that he will quit by the end of this year Berkshire Hathaway After an outstanding career, he led the group. Over the past sixty years, he has a capital of 5,500,000%, making him an investment legend.

this Omaha's Oracle Probably one of the best records. However, his advice to average investors is very simple. Buffett suggests buying at low cost S&P 500 Index funds, e.g. Vanguard S&P 500 ETF (nysemkt: voo). The simplicity of this strategy sounds boring.

But when you learn that the $1,000 monthly investment in this ETF could turn into $228,000 in just 10 years, you will quickly realize how powerful Buffett’s advice is. This is what investors need to know about this effective money-making strategy.

The Vanguard S&P 500 ETF has a total return of 219% over the past decade. Every year, this will translate into a 12.3% increase per year. In the long run, the S&P 500 has generated about 10% annual returns, so the past 10 years have been better, probably due to near-zero interest rates, the popularity of passive investment, and solid economic growth.

It is worth pointing out that past results cannot guarantee future returns. But let's assume that the Vanguard S&P 500 ETF registered the same gains over the next decade, which is obviously unpredictable. If you invest $1,000 in this investment vehicle per month, then 10 years later (120 investments in total) you will be staring at the $228,000 balance in your portfolio. This is an amazing result.

That's magic Average USD Cost. It eliminates the need to try the right time market and buy it in one go. Instead, investors allocate their funds to the Vanguard S&P 500 ETF monthly. This allows investors to take advantage of multiple price points while developing valuable habits of consistent investment.

Everyone wants to be a successful stock picker like Warren Buffett. But the truth is that not only do we do not have the expert financial modeling and business analytics skills, but the time we lack may not have enough time to do this. Here, buying the Vanguard S&P 500 ETF can really shine as a low maintenance strategy.