Will IRA actually help more people save money to retire? – Retirement Research Center

Let's see if Fintech and State Auto-Iras make a difference.

Individual retirement accounts (IRAs) holding more than half of the total assets of private retirement assets have been introduced into a way for workers without employer-sponsored plans to save retirement plans. Instead, they are primarily used as tools for rollovers of employer-sponsored programs, with direct donations traditionally accounting for only a small percentage of the annual inflow (see Figure 1).

However, in recent years, two developments may affect contributions: 1) the dissemination of the national auto program, which recruited Roth IRA among workers without coverage; 2) the growth of fintech platforms contributed by the IRA, and sometimes even inspire the IRA.

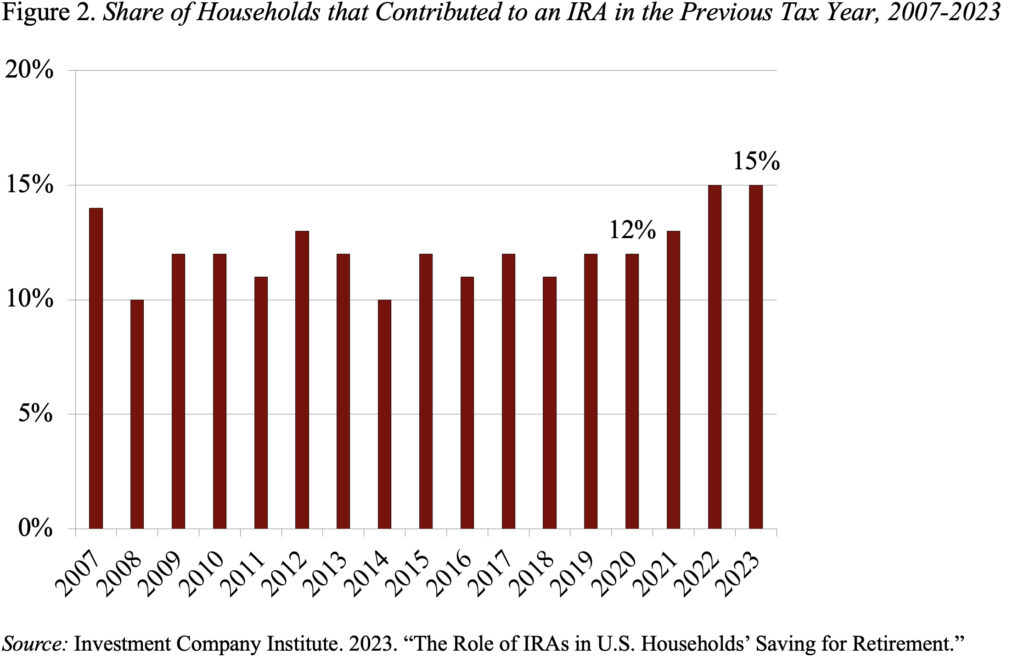

In fact, the share of contributing families increased (see Figure 2). The question is whether automated IRA programs and fintech play a role, and whether the growth of contributors reflects an increase in coverage, or is the larger footprint of tax collection only for those already covered.

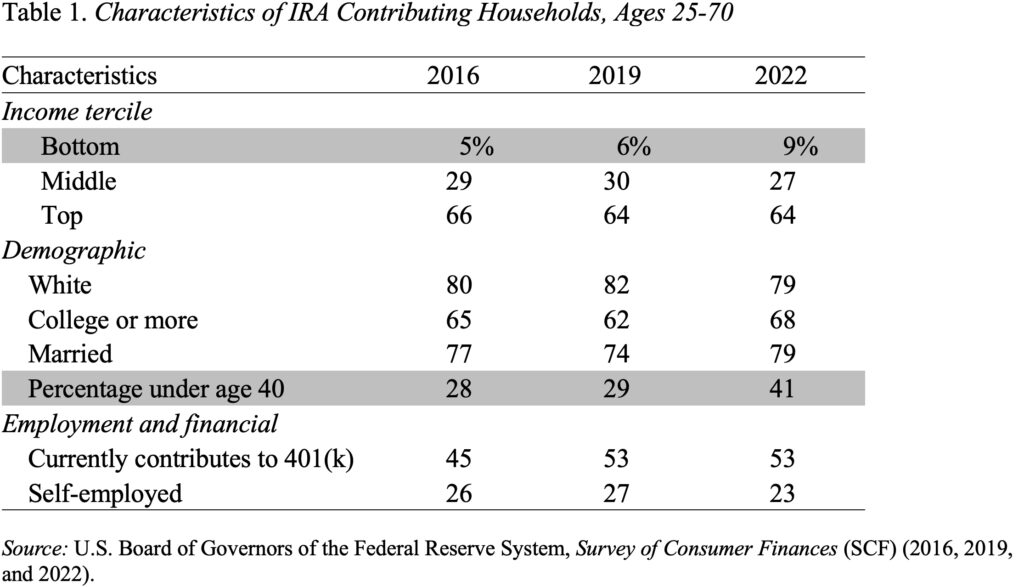

To answer this question, we examined the characteristics of the IRA from the Federal Reserve in 2016, 2019 and 2022 Consumer Financial Survey (See Table 1). At first, the pattern looked almost the same over the years. However, two changes stand out. First, at the bottom of the income distribution, the share of contributors increased from 5% to 9%, and second, the share of contributors under the age of 40 increased from 28% to 41%.

By definition, any impact of a new automated IRA program must be moderate, as the total number of contributors is only one million, while 2022 contributed families to 20 million IRAs in 2022. That said, these plans can well explain the growth in the lowest third of the income distribution contribution between 2019 and 2022. These could be new depositors who are getting tax benefits through Roth IRAS.

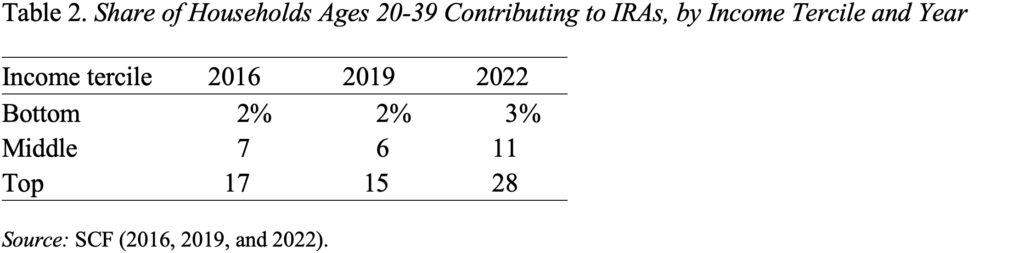

Likewise, fintech must definitely explain the changes in the age distribution of contributors – often only young tech investors turn to cell phones to save retirement. But who are these new young IRA contributors? It turns out that the increase in the percentage of households under 40 is concentrated in the highest income households (see Table 2). The middle three plates also showed moderate growth – though from the real low level.

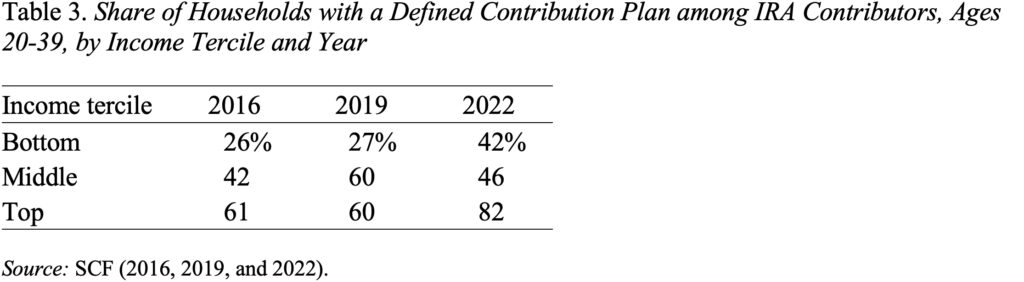

The question is whether the contributions to the foundations inspire growth lead to increased coverage. Table 3 shows that for the highest tee – all actions – 82% of the contributors already have 401 (k) type plans. If technology makes it really easy to contribute to a tax-friendly savings account, then a tech-savvy technology will take advantage of this opportunity.

Most importantly, in addition to the state automatic IRA program, IRAs are still those who receive more tax benefits in retirement assets than mechanisms to increase coverage.