3 Reasons Why Bitcoin Still a Terrible Idea in 401(k) – Retirement Research Center

What is the Ministry of Labor’s idea?

The U.S. Department of Labor (DOL) has just revoked guidance for 2022 that discourages trustees from including cryptocurrency options such as Bitcoin in their 401(k) retirement plans. DOL said it was just removing the agency's thumb from scale, “neither endorsing nor opposing” the trustees, who decided to include the cryptocurrency option on their 401(k) menu. But come on, why would DOL have all this trouble without adding other cryptocurrencies in the 401(k) account?

Bitcoin in 401(k)S is a terrible idea. Participants don't understand the product, it's a speculative and turbulent investment, traditional investments are unlikely to improve returns, and for 401(k)s, this may not be a cautious option.

Lots of hype – chaos

Bitcoin has received a lot of hype, but people don’t understand what it is. This is a strange product. This is a form of digital currency that uses blockchain technology to support transactions between users, but the value of the currency seems to fluctuate significantly. Warren Buffett famously said that he would not buy all the bitcoins in the world for $25. Bitcoin does not generate any cash flow, so it does not bring any returns to investors. The only way for investors to make a profit is to sell it at a higher price. It's more like gambling than a productive investment.

For some, gambling has paid off (see Figure 1). But it was a crazy journey. It is not clear where it goes from here.

You can do better in index funds

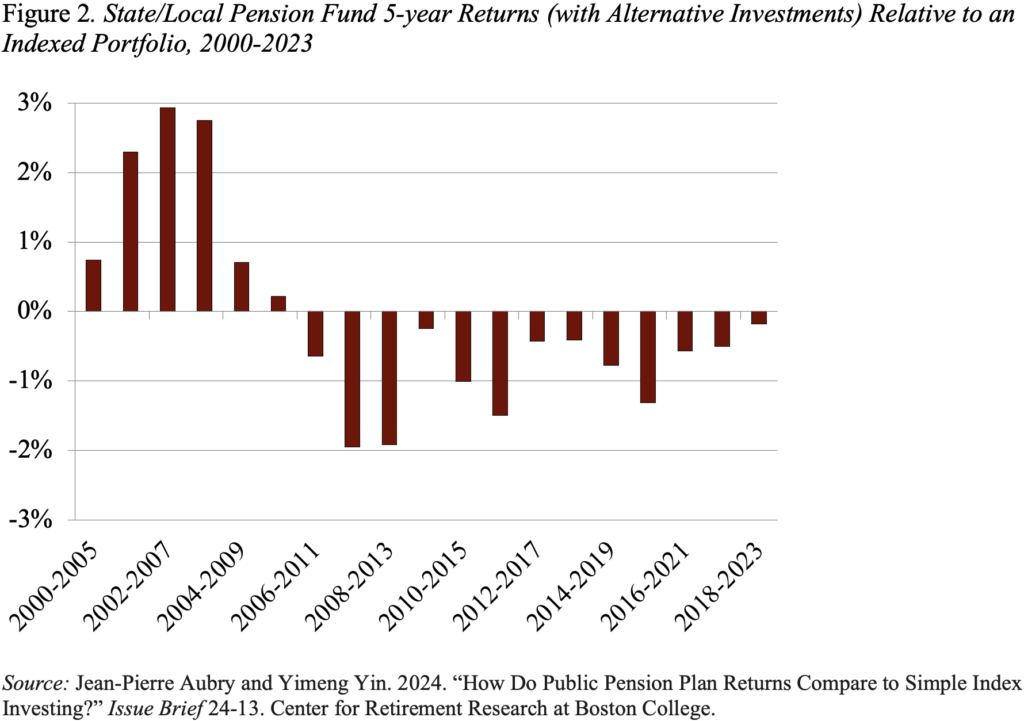

But it is clear that getting rid of traditional stocks and bonds does not necessarily lead to higher returns. Several studies examined the investment performance of state and local pension plans that increasingly shifted from traditional assets to alternatives such as private equity, hedge funds, real estate and commodities, and compared this performance to indexed portfolios and 40% bonds from the hypothetical 60% stock and 40% bonds. Research has found that by investing in passive index funds, public pensions may achieve higher returns. The most comprehensive assessments have no alternative benefits for the entire period from 2000 to the present, indicating a deficit since the global financial crisis. In short, there is no evidence that exoticism produces higher returns, which is likely to be hurt.

Too risky for the 401(k) plan

Finally, at least one expert believes that bitcoin should not be available in 401(k) at present. To meet ERISA's trust standards, threshold consideration is the general acceptability of asset classes to a wide range of investors. In this case, the most relevant broad investor would be the trustees who define the welfare plan. Most defined welfare plans do not invest in Bitcoin. 401(k) trustees should be more cautious when it comes to investment than trustees of defined welfare plans. The established welfare scheme involves a large amount of capital, managed by professional trustees with a long-term perspective; the 401(k) scheme involves small accounts managed by unskilled investors with a shorter time frame. It does not make sense to provide asset classes to 401(k) participants before they are accepted by professional trustees of defined welfare programs.

In short, adding bitcoin to the menu of 401(k) plans is not prudent, it introduces unnecessary risks and is unlikely to improve returns. DOL should not open the door to such activities. The agency should protect 401(k) participants rather than let retirement work work.